Get to Know Your Risk Tolerance

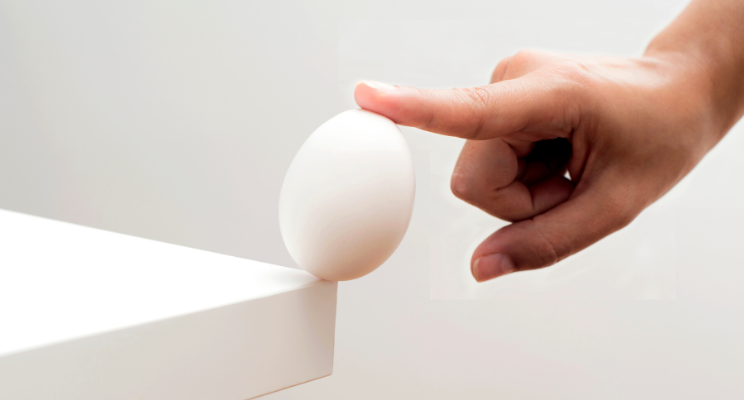

When constructing a portfolio, it’s critical to understand three important factors: your goals, your time horizon, and your risk tolerance. Of those three, risk tolerance can be the trickiest to get a handle on, especially since it can be determined in large part by your emotions and how well you handle turbulence in the market. Here’s a look at what you need to know.

What is risk tolerance?

To begin getting a handle on risk tolerance, it’s important to understand that different investments have different risk and reward profiles. For example, stocks tend to be relatively risky investments; prices can fluctuate widely in the short term. In return for taking on this risk, stocks offer investors higher potential returns. Bonds, on the other hand, present much less risk. While it’s possible that bond issuers could default, generally speaking, investors receive their investment back plus interest. Bonds’ lower risk profile translates into lower potential returns for investors.

Risk tolerance refers to how much money an investor is willing to lose in the short term for a shot at greater potential gains over the long term. Everyone’s risk tolerance is going to be different and will depend on several factors, including age, income, overall assets, long-term financial goals, and personality.

How to determine your risk tolerance

To figure out your risk tolerance, it can help to ask yourself questions such as:

- What are my investment goals?

- How much investment capital do I have to work with, and do I have other sources of income?

- What is my time horizon? When will I need to liquidate my investment?

- How much of my investment can I stand to lose if the market crashes?

With a clear idea of financial goals in mind, an investor is better positioned to determine what sort of investment assets are likely to help achieve those goals. For example, investors saving for retirement may want to take advantage of the growth potential offered by stocks.

Investors with a stable source of income at their disposal may be in a position to take on more risk with their investable assets.

Time horizon is closely tied to risk tolerance. For example, a younger investor saving for retirement may be willing to devote a higher portion of their portfolio to riskier investments, such as stocks, because they have more time to ride out market volatility and recoup potential losses down the road. Once that same investor begins approaching retirement age, they may find they need the return on their investment to be more predictable, and their risk tolerance will decrease. At that point, they may begin to shift their asset allocation to lower-risk investments, such as bonds and cash.

Finally, it’s important to know yourself. What types of investment decisions will keep you up at night? If you’re losing sleep over market volatility, for example, it might be a good sign that it’s time to consult your financial advisor about building a more conservative portfolio. If you’re someone with a hardier disposition who makes an investment and doesn’t even look when markets get bumpy, you may be able to tolerate a riskier portfolio.

Developing your portfolio

Once you understand your risk tolerance, you can work with an advisor to allocate assets in your portfolio accordingly. With a high-risk tolerance, you might hold 90% of your portfolio in stocks with just 10% in more conservative investments, for example. With a low-risk tolerance, you might hold 50% of your portfolio in stocks.

Your advisor can help you use other tools, such as diversification, to help manage risk and volatility within your portfolio. Holding many types of assets across factors such as sector, size, and geography can help ensure that while some investments may be struggling at a given moment, others may outperform.

Sources

https://www.investor.gov/introduction-investing/getting-started/assessing-your-risk-tolerance

https://www.cnbc.com/select/how-to-figure-out-your-risk-tolerance-investing/

Recent Aricles

Target Date Funds: What They Are and When to Use Them

Learn MoreLearn More

Are You Following the Financial Herd?

Learn MoreLearn More