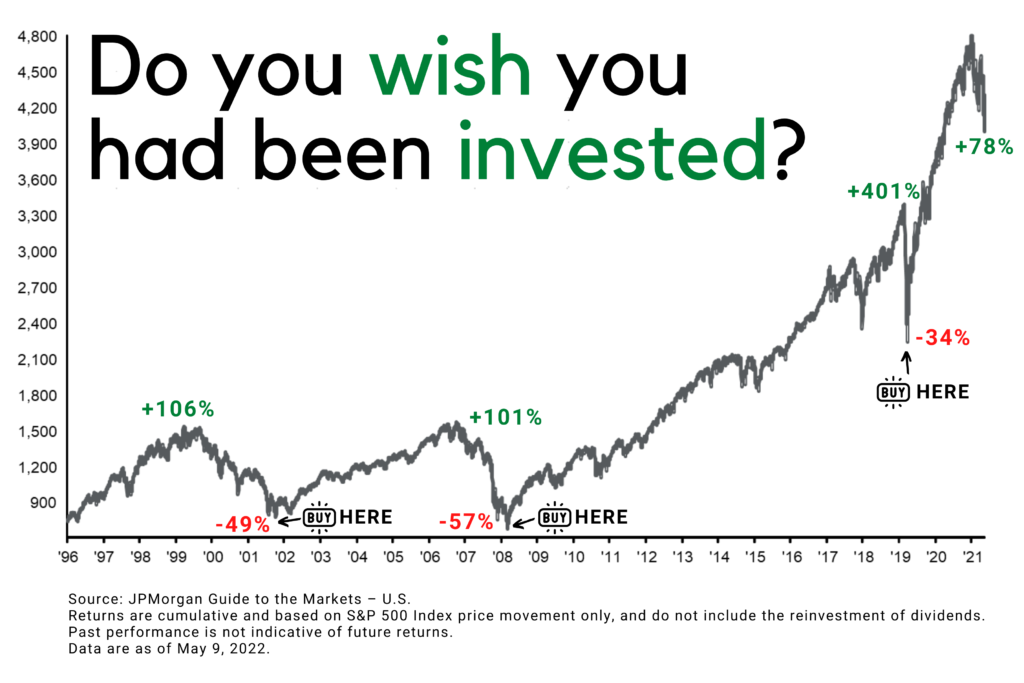

Hindsight Is 20/20

At some point in your life, you have probably heard someone wiser and more experienced tell you, “Hindsight is 20/20”. This phrase applies to investing as much as it does to life in general.

Looking back in time, we can see how lucrative it would have been to invest during very stressful and volatile market conditions — like what we are experiencing now. It is extremely difficult in the present, however, to act with this type of perspective.

Check out this chart and ask yourself, would you have invested (or stayed invested) during these low periods in the stock market? Had you acted with such foresight recalling the advice of the wiser and more experienced person, you would have profited years later.

If your time horizon and risk tolerance allow it, focus on the long-term gains that can be had from remaining calm and sticking to your plan during stretches like these.

Additional Resources

Plan Highlights Basic Steps (Eng-Span)

Learn MoreLearn More

Match Change (Eng & Span)

Learn MoreLearn More