Women, Retirement, and Their Unique Planning Considerations

In this insightful presentation, we explore the unique considerations women should keep in mind when planning for retirement. Discover key insights and practical strategies to help women achieve financial security and independence in their golden years. • Longer Lifespans: Women typically live longer than men, making long-term financial planning crucial. • Earnings Disparities: Addressing wage gaps and career interruptions is vital for building robust retirement savings. • Caregiver Roles: Balancing caregiving responsibilities with retirement saving strategies is essential for financial well-being.

In this insightful presentation, we explore the unique considerations women should keep in mind when planning for retirement. Discover key insights and practical strategies to help women achieve financial security and independence in their golden years.

- Longer Lifespans: Women typically live longer than men, making long-term financial planning crucial.

- Earnings Disparities: Addressing wage gaps and career interruptions is vital for building robust retirement savings.

- Caregiver Roles: Balancing caregiving responsibilities with retirement saving strategies is essential for financial well-being.

Additional Resources

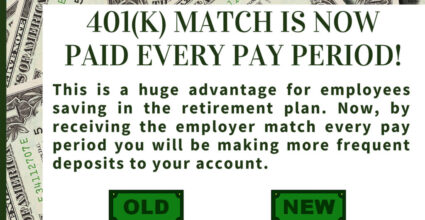

Match Change (Eng & Span)

Learn MoreLearn More

Women, Retirement, and Their Unique Planning Considerations

Learn MoreLearn More